Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

Credit sales refer to a sale in which the amount owed will be paid at a later date. In other words, credit sales are purchases made by customers who do not render payment in full, in cash, at the time of purchase. To learn more, check out CFI’s Credit Analyst Certification program.

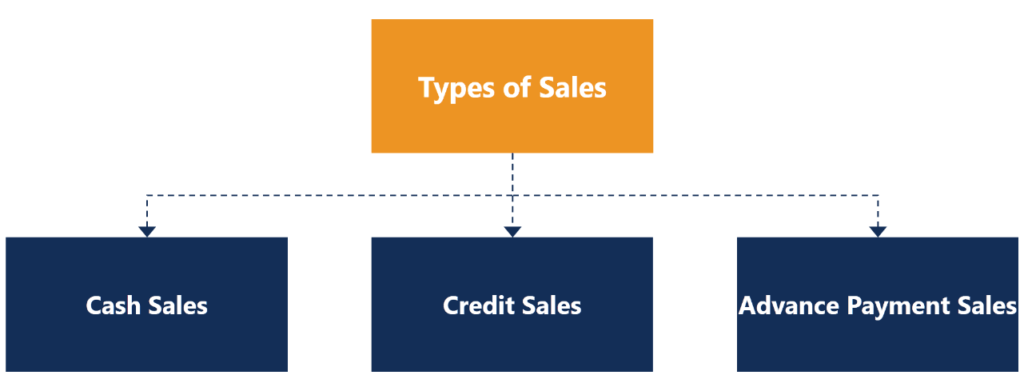

There are three main types of sales transactions: cash sales, credit sales, and advance payment sales. The difference between these sales transactions simply lies in the timing of when cash is received.

1. Cash sales: Cash is collected when the sale is made and the goods or services are delivered to the customer.

2. Credit sales: Customers are given a period of time after the sale is made to pay the seller.

3. Advance payment sales: Customers pay the seller in advance before the sale is made.

It is common for credit sales to include credit terms. Credit terms are terms that indicate when payment is due for sales that are made on credit, possible discounts, and any applicable interest or late payment fees.

For example, the credit terms for credit sales may be 2/10, net 30. This means that the amount is due in 30 days (net 30). However, if the customer pays within 10 days, a 2% discount will be applied.

Assume Company A sold $10,000 worth of goods to Michael. Company A offers credit terms 5/10, net 30. If Michael pays the amount owed ($10,000) within 10 days, he would be able to enjoy a 5% discount. Therefore, the amount that Michael would need to pay for his purchases if he paid within 10 days would be $9,500.

On January 1, 2018, Company A sold computers and laptops to John on credit. The amount owed is $10,000, due on January 31, 2018. On January 30, 2018, John made the full payment of $10,000 for the computers and laptops.

The journal entries would be as follows:

| Date | Account Title | Debit | Credit |

| January 1, 2018 | Accounts Receivable | $10,000 | |

| Sales | $10,000 | ||

| To record the sale of goods to John on credit | |||

| Date | Account Title | Debit | Credit |

| January 30, 2018 | Cash | $10,000 | |

| Accounts Receivable | $10,000 | ||

| To record the full payment made by John for purchases on January 1, 2018 | |||

Consider the same example above – Company A selling goods to John on credit for $10,000, due on January 31, 2018. However, let us consider the effect of the credit terms 2/10 net 30 on this purchase.

The journal entries would be as follows:

| Date | Account Title | Debit | Credit |

| January 1, 2018 | Accounts Receivable | $10,000 | |

| Sales | $10,000 | ||

| To record the sale of goods to John on credit | |||

John decides to take advantage of the credit terms and thus pays on January 5, 2018:

| Date | Account Title | Debit | Credit |

| January 5, 2018 | Cash | $9,800 | |

| Cash Discount | $200 | ||

| Accounts Receivable | $10,000 | ||

| To record the sale of goods to John on credit with the credit discount | |||

John paid his invoice four days (January 5) after purchasing the goods on credit. Therefore, he would be able to enjoy a 2% discount on his credit purchase ($10,000 x 2% = $200).

As previously mentioned, credit sales are sales where the customer is given an extended period to pay. There are several advantages and disadvantages for a company offering credit sales to customers.

Thank you for reading CFI’s guide to Credit Sales. To develop your career in corporate finance, these additional CFI resources will be helpful:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.